Market Update

Global share markets had another strong month in November, rising 5.6% in local currency terms. Investors were encouraged by lower than expected year-on-year inflation in the US of 7.7%, down from 8.2% in the prior month.

The news of a possible peak of inflation also supported fixed interest or bond markets. Global bond markets rose almost 2.5%, and the New Zealand bond market rose almost 1% in November – quite decent returns when it comes to bond investments. These returns provided some reprieve for bond investors after higher interest rates have weighed on bond returns throughout much of 2022.

The New Zealand share market delivered a “modest” 2% for the month on the back of better than expected half-year results for New Zealand’s largest listed company – Fisher & Paykel Healthcare. The respiratory equipment manufacturer reported a 57% drop in profit as it came out of a period of significant Covid-induced demand. However, the drop in profit was less than investors were expecting, and the company ended the month up 20%.

Reserve Bank of New Zealand getting tough on inflation

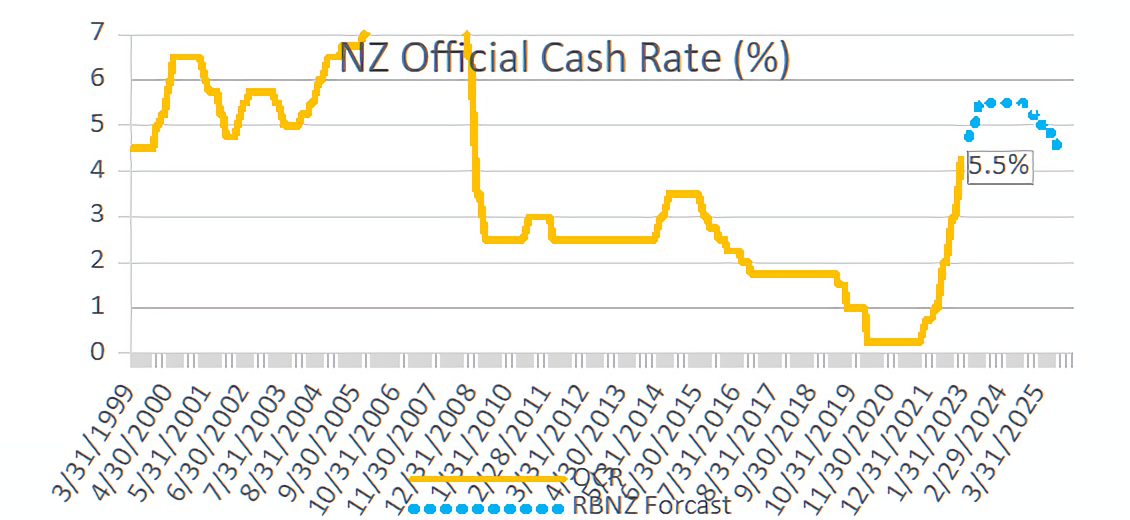

In November, the Reserve Bank of New Zealand (RBNZ) delivered its biggest-ever increase in the Official Cash Rate (OCR), raising New Zealand’s benchmark interest rate by 0.75% to 4.25%. This comes in response to stubbornly high inflation in New Zealand and the acknowledgment by the RBNZ that the longer inflation remains elevated, the harder it is to reduce.

A number of factors have contributed to the current inflationary pressure, many of which are global issues, including Covid-related supply-chain disruptions and the Ukraine conflict. However, perhaps the biggest culprit is the unprecedented level of stimulus provided by governments and central banks during the Covid-19 crisis, e.g. ultra-low interest rates and large-scale government bond purchases. For New Zealand, this stimulus boosted demand during the pandemic, but as our economy recovered this extra demand soon outstripped our economy’s capacity. As a result, the RBNZ is now in a position where they need to reduce demand in the New Zealand economy to ease inflationary pressures.

The main tool the RBNZ uses to control demand in the economy is the OCR, which influences short-term interest and mortgage rates. Higher interest rates encourage people to save more and put less on the credit card. Likewise, higher mortgage rates mean a higher percentage of household income goes towards servicing the mortgage, and discretionary spending has to be cut back. While this will be a burden for those with large mortgages, it is an effective tool for reducing demand in the economy.

How much higher will the OCR go?

In just over a year, the RBNZ has lifted the OCR from a record low of 0.25% to its current level of 4.25% and is forecasting a further increase to 5.5% within the next year. As always, there is significant uncertainty around OCR forecasts, and the actual OCR will depend on how quickly inflation falls back in line with the RBNZ’s 1 – 3% target range. Currently, the RBNZ expects it will be almost two years before inflation is back below 3%.

Managing risks and opportunities

One of the most significant impacts of rising short-term interest rates has been a cooling of the New Zealand housing market. Higher mortgage rates have been a significant contributor to the 11% decline in house prices we have seen since their peak in November 2021.

In anticipation of this risk, we reduced our portfolios’ exposure to retirement village operators such as Ryman Healthcare and Summerset Holdings midway through last year. These companies effectively hold large residential property portfolios, and had performed very well when their properties were appreciating at record rates. However, with rising interest rates weighing on property prices, we expect a drop in profitability for retirement village operators. Indeed, since reducing portfolios’ exposure to these retirement village operators, we have seen them collectively underperform the broader New Zealand market by 30%.

We also expect rising interest rates and the weaker property market to cause a slowdown in construction activity as prospective gains from new developments diminish, and securing financing for these projects becomes more expensive.

Fletcher Building was a beneficiary of record-high construction activity seen over the last few years, but we expect this to reverse as construction activity slows down, so we have reduced portfolios’ holding in Fletcher Building more recently.

The Booster KiwiSaver Scheme, Booster Investment Scheme and Booster SuperScheme are issued and managed by Booster Investment Management Ltd. For a copy of the Scheme product disclosure statements, go to www.booster.co.nz