Market Update

Global share markets had another strong month in June, rising 3.7% in New Zealand dollar terms. Investors were encouraged by a sharp drop in year-on-year inflation in the US of 4.0% – still above target but substantially lower than the 9.1% recorded in June 2022.

International bond markets were flat over the month as central banks transitioned from hiking their respective policy rates to pausing to evaluate incoming data. This is a signal that interest rates globally may be nearing their peak. The US Federal Reserve maintained their policy rate at 5.25%, the first pause after 10 consecutive hikes over the past 15 months. This should be supportive of bond returns looking forward.

The first half of the year has started off strongly for financial markets, regaining the lost ground they experienced in 2022. Global share markets have led the way, up 19% in New Zealand dollar terms. This highlights the importance of staying invested during volatile times and not focusing on news headlines which tend to focus on negatives.

Widening Booster’s direct investments in attractive, unlisted NZ assets

In earlier updates, we discussed the benefits of including an allocation to ‘unlisted’ investments in your portfolio – those not traded on public share or bond markets. When selected appropriately, this can help diversify some of the risks in your portfolio and enhance returns while also providing a way to invest back into New Zealand.

Our core multi-sector funds include a strategic allocation to various unlisted investments, which has grown to include productive NZ land investments, private NZ businesses, innovative NZ startups, and direct private income investments.

Private income (also known as direct lending or private credit) covers a broad spectrum and can provide strong investor protections, attractive pricing, and diversification benefits by performing differently to publicly listed assets like bonds. This comes from both a ‘liquidity premium’ which tends to support the yield investors receive, and less volatility in returns when interest rates rise and fall. On top of the enhanced yield and diversification benefits, the interest rate on these loans typically reset monthly (floating rate), benefiting in a rising interest rate environment.

These benefits are exemplified across our private income investments to date, including our most recent investment – a loan to FleetPartners secured over a basket of automotive loans to NZ businesses.

Why FleetPartners?

FleetPartner NZ is unique in the automotive lending space as they focus on leasing vehicles to corporates, with almost 3,000 corporate customers. FleetPartners NZ has a proven track record dating back to 1977 and has four offices across the country, with 87 employees offering the widest regional office coverage of any fleet company in the country.

This investment offers an attractive risk-adjusted return secured by the value of over 25,000 vehicles and operating leases. It has the benefit of being a floating interest rate that resets monthly, meaning the interest received on the loan will increase as interest rates rise. This means it is also not subject to the same volatility as traditional bond investments, whose market values change when interest rates are volatile.

Diversification across Private Income

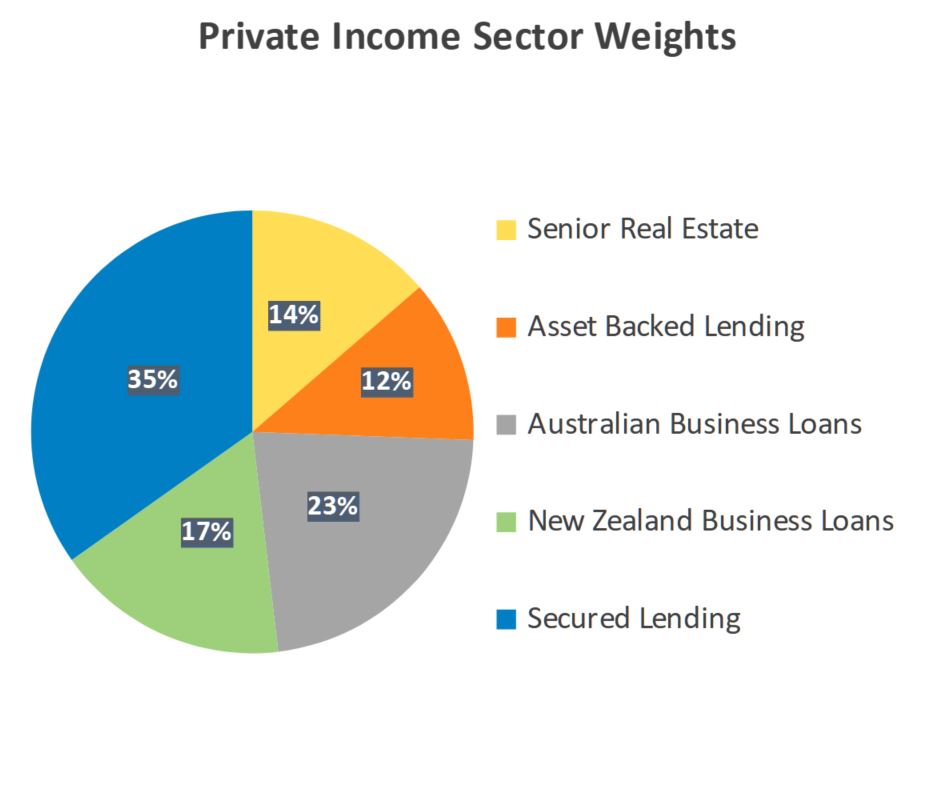

Private income currently makes up a measured portion of our portfolios’ fixed interest allocation; however, we are focused on gradually and selectively building this allocation further to support the future income and resilience of portfolio returns. Since introducing this asset class in 2021, we have made good progress in diversifying portfolios private income investments across a range of sectors, as displayed to the right. Importantly, each sector has further diversification underlying the exposure, such as business loans across Australia and New Zealand which incorporates almost 100 individual loans.

Asset backed lending (FleetPartners) provides diversification across NZ businesses and automobiles, while Senior Real Estate represents a loan to an entity owned by Ngati Toa Rangatira and is well secured over 40 school properties across the Wellington region, purchased by way of a Treaty of Waitangi settlement.

We are excited to introduce this new investment that gives investors access to a unique private income asset, and look forward to updating you in the future as we build out the allocation further across multi-sector funds.

The Booster KiwiSaver Scheme, Booster Investment Scheme and Booster SuperScheme are issued and managed by Booster Investment Management Ltd. For a copy of the Scheme product disclosure statements, go to www.booster.co.nz