On so many levels but from an investing perspective it allows us to benefit from the 8th wonder of the world compounding! People often tell me all the very valid reasons not to ‘invest’ right now. These excuses or reasons simply dimmish our investment runway considerably and when it’s the right time they simply can’t make up the lost ground of compounding.

As the quote goes “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”A lovely Mum I know said simply – “Ailsa I’m booking a couple of annual leave days, once the kids are all back in school, to do some life admin!” Follow her lead book a day & let’s have coffee!

Focus on What Matters

Albert Einstein famously said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” The simple truth of compounding returns is the most important thing that matters for the long-term investor. Yet in today’s world, we are consistently bombarded with distractions, become preoccupied with other things, and we forget this simple truth.

Companies try to sell us the latest products that promise to make our lives better and more efficient. Smartphones are a constant barrage of notifications and seem to be more adept at taking our time than being smart. The bank wants to give us a new credit card when we just told them we are trying to save. The electricity company tries to lure us to their service with a $200 discount; they then say switch our internet too, and we get a free TV. Now the online streaming service is telling us their new show is out. All 30 episodes. Watch it tonight, now now now!

All these things create clutter in our lives, which overwhelms us, makes us more emotional, less rational, and distracts us from what really matters. As an investor, you are subject to even more distractions. Markets are up. Markets are down. A recession is coming. It’s a bull market! Constant noise that can distract you from your long-term financial plan.

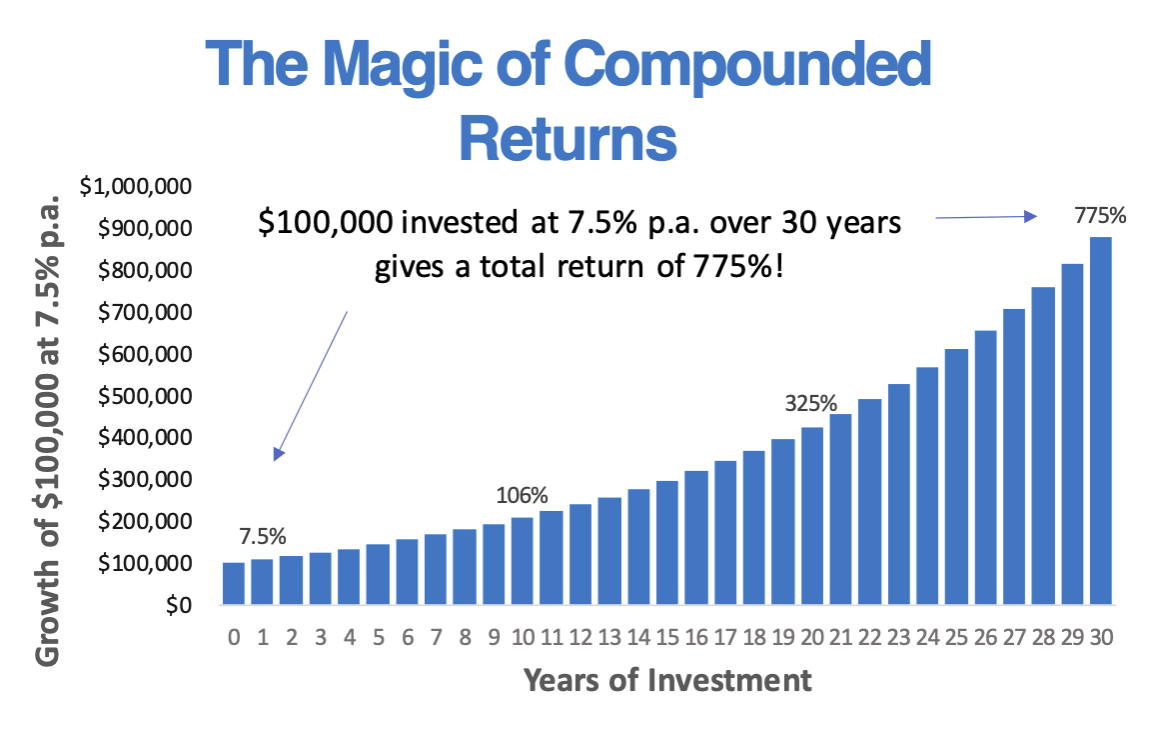

For many of us, our investment horizon is long. It could be that we’re saving for retirement, or even those having just made it to retirement. We may be able to invest for 10, 20 or even 30 years. And that’s when compounding really takes effect, leading to significant wealth creation. Using our long-term expected returns for a high growth fund of 7.5% (after tax and management fees), investing $100,000 grows to $206,000 after 10 years, $425,000 after 20 years and $875,000 after 30 years. This is the simple truth of Einstein’s famous quote; the magic of compounded returns is what matters most for long-term investors. It is important to not interrupt the compounding and stick to your long-term investment plan.

Market Update

- 2023 was a strong year for global share markets, which gained 24% in New Zealand dollar terms. One catalyst that drove market returns for the year was AI integration and the performance of the businesses set to benefit from this new wave of technology. The so-called ‘Magnificent 7’ (the seven largest, most dominant tech companies in the US), Apple, Amazon, Alphabet, Microsoft, Meta, Telsa, and Nvidia combined delivered a return of over 100%!

- Bond markets also had a solid year, with both New Zealand and global benchmarks up over 6%. Towards the end of the year, investors gained more confidence that central banks had finally done enough to tame inflation and would be in a position to start reducing interest rates in 2024. In an environment of falling interest rates, bonds tend to increase in value, enhancing the return for existing bond investors.

- In contrast to strong global share and bond market returns, the New Zealand share market delivered a more modest 4% gain in 2023. The New Zealand market is more weighted towards dividend-paying businesses such as utilities and listed property companies and can therefore be generally seen as more defensive when compared to other listed markets.