Market Update

Most global share markets were positive in July, spurred higher by the energy and financial sectors, which makes for a change from the first half of the year where technology companies drove markets.

The Australian share market rallied almost 3% on higher energy prices, as resource companies make up a significant part of that market. Global share markets were also up 3% in local currency terms; however, a weak US dollar (-1.5%) offset some of the performance for unhedged NZ investors.

• The key US share market saw a number of companies report earnings for the June quarter. Overall, these results highlight the resiliency of companies amidst slowing economic growth and elevated inflation. While earnings have declined from where they were a year ago, most results beat market expectations. In particular, the financials sector performed well after a tumultuous start to the year, which saw the collapse of several small regional banks. One of our external active managers, California-based Fisher Investments, used the opportunities earlier in the year to increase their exposure to financials. This paid off well in July, with holdings like Bank of America (up 10%), Morgan Stanley (up 7%), and T.Rowe Price (up 8%), all reporting strong earnings, and their share prices rose as a result.

The Power of Patience: The Importance of Staying Invested

2022 was a challenging year for investors, with global share markets declining 16% in local currency terms. In contrast, global share markets have made a strong recovery so far in 2023 – up over 18% year to date. This recovery serves as a timely reminder of one of the most valuable lessons in investing – the importance of staying invested and resisting the urge to ‘time the market’.

Trying to predict short-term market fluctuations in financial markets can be tempting, particularly during periods of uncertainty and alarming news headlines. However, as illustrated so far this year, financial markets are forward-looking and can still perform well regardless of the news headlines. As a result, emotionally driven investment decisions often lead to missed opportunities and lower overall returns. Instead, adopting a long-term investment perspective enables investors to benefit from the market’s inherent tendency to grow over time, and avoid the costly mistake of mistiming the market.

The risk of timing the market

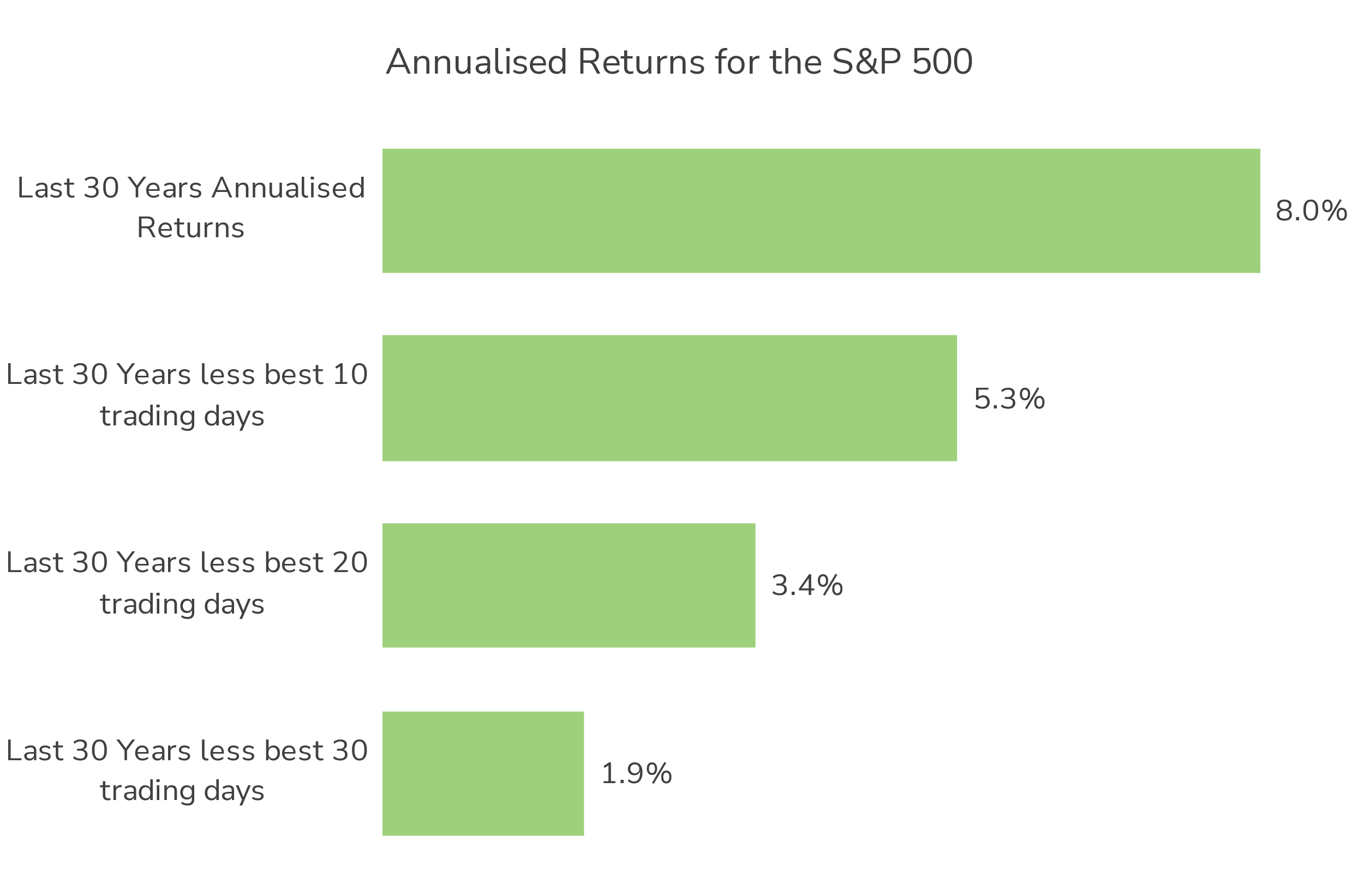

Studies have shown that attempting to time the market can lead to lower returns compared to a patient, buy-and-hold strategy. This is because missing just a few of the best trading days in the share market can significantly impact overall returns. To illustrate this, let’s consider the US share market benchmark, the S&P 500 Index, over the last 30 years. During this period, the S&P500 delivered a respectable annualised return of 8%, resulting in a total return of 919%. However, if an investor missed out on the best 20 trading days during these 30 years, their annualised return would fall to a mere 3.4%, reducing their total return to only 175% – a stark contrast to the potential wealth they could have accumulated.

What’s more, the share markets’ best trading days often coincide with the biggest market downturns, such as the 2008 Global Financial Crisis and the 2020 Covid pandemic. This highlights how markets can move quickly and are always forward looking. It also reinforces the risks of trying to time the market, particularly during periods of market volatility. By trying to avoid losses, investors may inadvertently miss out on some of the best days to be invested, which can substantially reduce an investor’s long-term returns.

Conclusion

In conclusion, the recent market recovery serves as a reminder of the importance of adopting a patient approach to investing and resisting the temptation to time the market. To achieve your financial goals, it is best to adhere to a carefully selected investment plan that aligns with your personal investment time horizon and risk tolerance. Investing is akin to a marathon, not a sprint, and the power of patience can unlock the door to financial prosperity in the long run. As Warren Buffett wisely said, “The stock market is a device to transfer money from the impatient to the patient.”

The Booster KiwiSaver Scheme, Booster Investment Scheme and Booster SuperScheme are issued and managed by Booster Investment Management Ltd. For a copy of the Scheme product disclosure statements, go to www.booster.co.nz