Market Update

May saw global share markets deliver a flat return in local currency terms. Worries over the US debt ceiling made headlines; however, a deal between Republicans and Democrats was reached shortly after month-end, and the crisis was averted.

The global share managers we employ to manage part of your global share investments performed well during May. California-based Fisher Investments led the way, supported by their holdings in a number of technology companies. For example, Nvidia jumped 40% after it raised its outlook above expectations thanks to demand for its AI processor chips. At the time of writing, the stock is up over 160% year to date.

In May, we saw the release of the latest NZ budget, with the release pointing toward increased debt issuance, more spending and a significant cash deficit. Global credit rating agency S&P reiterated their previous warning around NZ debt levels, indicating a credit rating downgrade may be in the works if we stay on this same path with respect to government spending.

Central banks turning the tide against inflation?

At 6.7%, New Zealand’s inflation rate remains uncomfortably high and is putting pressure on many Kiwi households. However, it is worth noting that inflation has been slowly trending down in New Zealand from its peak of 7.3% last year. Globally we are seeing a similar trend, with inflation still being elevated but showing signs of receding. For instance, the US inflation rate reached its peak at 9.1% last year but has since declined to 4.9%.

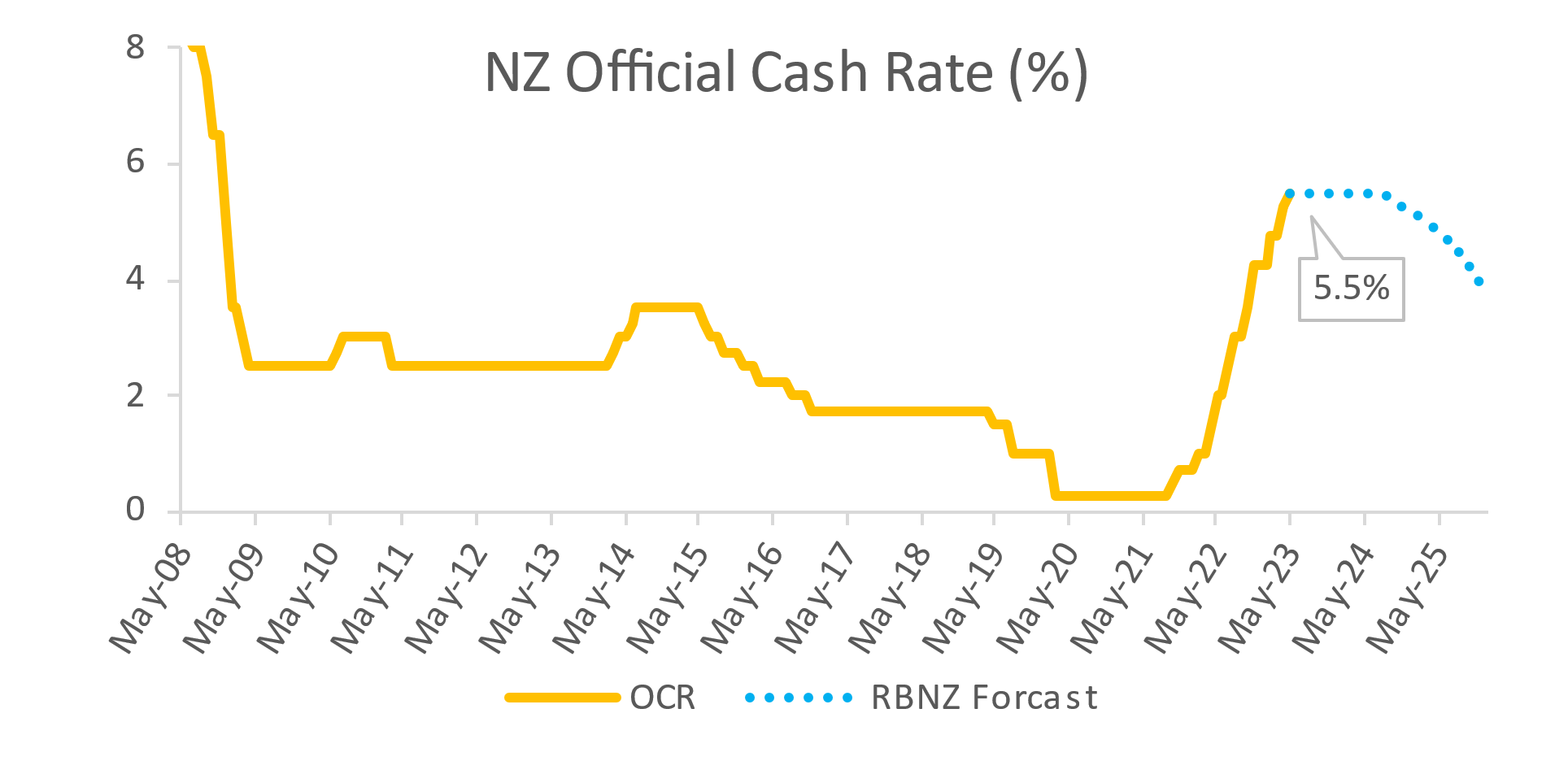

While the battle against inflation is far from over, central banks, including the Reserve Bank of New Zealand (RBNZ), have demonstrated that their efforts to tame inflation are gaining traction. The primary tool used by the RBNZ to manage inflation is the Offical Cash Rate (OCR), which influences short-term interest and mortgage rates. Higher interest rates encourage people to save more and put less on the credit card. Additionally, higher mortgage rates lead to a larger proportion of household income being allocated towards mortgage repayments, resulting in reduced discretionary spending. Although this places a burden on those with substantial mortgages, it is effective in reducing demand which, in turn, helps curb inflation within the economy.

OCR outlook

In May, the RBNZ delivered its 12th consecutive OCR hike, elevating New Zealand’s benchmark interest rate from a record low of 0.25% in October 2021 to its current level of 5.5%. However, this hike is projected to be the final one, as the RBNZ announced its intention to maintain the OCR at 5.5% for the next year. Nonetheless, there remains considerable uncertainty surrounding the RBNZ’s OCR forecast. The actual OCR may rise further if inflation proves to be more persistent than anticipated. Conversely, if the economy slows excessively and inflation drops rapidly, the RBNZ would likely reduce the OCR earlier than currently forecasted.

Managing risks and opportunities

One notable consequence of the rising OCR, which strongly impacts mortgage rates, has been the cooling of the New Zealand housing market. Higher mortgage rates have significantly contributed to the 17.5% decline in house prices from their peak in November 2021.

In anticipation of this risk, we adjusted our portfolios in mid-2021 to reduce exposure to retirement village operators like Ryman Healthcare and Summerset Holdings. These companies hold substantial residential property portfolios and performed exceptionally well when property prices were skyrocketing. However, with rising interest rates dampening property values, we anticipated a decline in profitability for retirement village operators. Indeed, in May, several retirement village operators released their financial statements showing their profits fell 60-70% compared to the prior year. This has also been reflected in their share price performance, with the sector collectively underperforming the broader New Zealand share market by 30% since mid-2021.

However, with the RBNZ signalling the peak in the OCR, a key headwind for the housing market is abating, and the scope for further underperformance for retirement village operators has reduced. Consequently, we have increased the holdings of the retirement village operators in Booster portfolios. This proactive approach to adjusting portfolio holdings in response to changing market conditions exemplifies how active management can help mitigate risks and maximise your portfolio’s opportunities.

The Booster KiwiSaver Scheme, Booster Investment Scheme and Booster SuperScheme are issued and managed by Booster Investment Management Ltd. For a copy of the Scheme product disclosure statements, go to www.booster.co.nz